WPP’s Share Price Tumbles 11.4% In January As Analysts Baulk At Its Digital Credentials

In what will surely prove more grist to the mill for Sir Martin, WPP’s share price tumbled more than 11 per cent over January.

According to data by S&P Global Market Intelligence, the hefty whack came after London analysts failed to be won over by claims made by CEO, Mark Read (main photo), and the senior management team.

Over the past month, heavyweight brokerage Goldman Sachs downgraded the stock from buy to neutral following Read’s presentation in mid-January.

Worse, Bank of America reportedly downgraded it to underperform. The chart below highlights the 11.4 per cent fall over January. However, it has recovered since the start of February.

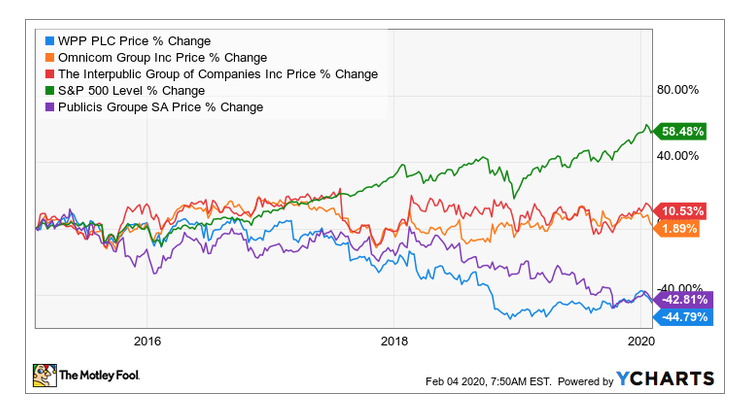

A quick look at WPP’s fortunes against the other holding companies Publicis, Omnicom and IPG, shows it’s been the worst performing of the four for some time.

The problem for WPP appears to be convincing the analysts of its relevance. It’s been suggested that its media buying arm, GroupM, is really the only profitable part of the world’s biggest media company. (So much so, Sorrell has repeatedly said that GroupM should be sold to Accenture for $US15 billion.)

GroupM still relies on big ad spends from global corporations that, in turn, are increasingly shrinking budgets and moving the dollars they do have away from GroupM’s core – TV advertising – and into cheaper digital and e-commerce options.

Apparently, Read’s mid-January presentation emphasised that WPP was increasingly digital focused and that’s where the company’s growth would come from.

“WPP is extremely well positioned to help our clients understand how the world is being adjusted by those companies,” Read is reported to have said. In other words, clients will need WPP to help them manage the avalanche of data that is coming their way.

Commenting on WPP’s conundrum, Lee Samaha wrote on Nasdaq.com: “Read’s argument may well be valid, but the deeper question is whether WPP’s growth opportunity from helping clients manage their online campaigns will offset declines from its traditional business.

“Moreover, large clients are developing their own in-house capabilities to handle online marketing, and large consultancies like Accenture, Deloitte, Ernst & Young, and also IBM are increasingly muscling in on a market that they may understand better than the ad agencies.

“Looking ahead, WPP and the other traditional agencies are going to have to convince the market they are capable of managing the dynamic shifts in their industry. That’s the only way they’ll avoid the fate of long-term structural decline,” Samaha wrote.

Latest News

Enjoy A Hahn Solo… And May The Fourth Be With You

This May the fourth Hahn will celebrate alongside Star Wars fans rewarding their passion via a giant Hahn travelling solo through the sky. It’s the one day of the year when all sci-fi fans rejoice and giggle to themselves and Hahn in partnership with Thinkerbell, UM and Affinity is celebrating with an out of this […]

DMARGE Founder Unveils Creator-Led Social Media Agency Feedstar

New creator-led social media agency Feedstar to be aimed directly at Gen Zs. Well, they'd hardly want print, would they?

TV Ratings (02/05/2024): A total of 1,753,000 Aussies Witness Port Adelaide’s Defeat

Seven's AFL numbers almost double that of the NRL last night. The NRL still easily winning for ruptured ACLs.

Hotglue Cashes In With La Trobe Financial Digital Media Account

Hotglue staffers learning their cashflows from their collaterals today after nabbing La Trobe Financial's digital media.

M&C Saatchi’s Sydney Creative Lead Exits

B&T's stopping short of calling it a revolving door at M&C at the present, but there's definitely heat on the hinges.

Taylor Swift’s Music Re-Enters TikTok As Universal Pens Landmark Deal

Yes, B&T may have spent 152 hours failing to get Taylor Swift tickets, but, as you'll read here, it's all behind us now.

HAVAS Red launches inaugural Influencer White Paper

Havas Red has debuted its first influencer white paper. Unless you print it out in colour, of course.

Two Sides Global Campaign Reports Increasing Greenwashing As Organisations Focus On Sustainability

New report confirms greenwashing's on the rise. Apparently Mars' 'work, rest & play' claims also under investigation.

Aruga Launches New HQ & Changed Ownership Structure

PR agency Aruga proves Brisbane is 'so hot right now'. So hot in fact, Adelaide's had to go on anti-anxiety meds.

Delicious & American Express Partner To Launch Month Out 2024 In Sydney

Cost of living got you eating noodles prepared in the two-minute style? Why not live vicariously through this.

Aussie Ad Market Continues Decline In March

The belt-tightening in adland shows signs of a turnaround soon. Bar the belt-loosening at the all-you-can-eat buffet.

VMA Focuses On Skills And Training For Members

If there was a post-COVID hangover (bar the anti-vax ranters) it was the rise in skills shortages. Here's another one.

Nearly 90% Of Consumers Want Transparency About AI Images, Finds Getty Images Report

Study finds consumers want transparency around AI images. Couldn't care less about photoshopped magazine covers.

The National Breast Cancer Foundation Partners With VML To Boost Funds

Anyone else feel we've exhausted the office morning tea for cancer? B&T proposes the office moonshine still instead.

Perry ‘Pez’ Lazaris Named New National Hit Network Announcer

Why is it mandatory for the media to only publish the nicknames of people in radio & underworld crime figures?

Before Adland: Garry Dawson’s Journey From Teacher To Marketer

Here, the Hopeful Monsters marketer talks his shift from the classroom to the room wherever marketers congregate.

Scott Cam Urges Tradies To Prioritise Sun Protection

The Block host promoting sun protection to tradies. Also, don't try getting into the RSL after 6pm wearing high viz.

PubMatic Study: Advertising On Retail Media Is 50% More Effective Than Social Media

New study finds retail media 50% more effective than social. B&T says two-for-one Tim Tams trumps the lot.

From MOWING to life GROWING: Jim Penman launches ‘Life Coaching’ services

Can't decide on getting the hedges trimmed or finding a deeper meaning to life? You're in luck with this new venture.

Budweiser Brazil Turns Songs That Name Drop The Iconic Brand Into Spotify Ads

It's strange that Budweiser never found a market among beer-swilling Aussies. Then again, neither did the fluffy duck.

Effie Worldwide Strengthens Board With 6 New Members

B&T hopes everyone's wearing their Maseur sandals at the Effies, as it's standing room only at the next board meeting.

Special Enlist A Penguin Named Nigel In Latest Energy Campaign For Contact

Special unveils Nigel the penguin in work for energy provider Contact. Apparently Percy the peacock was booked.

Anya Taylor-Joy, Chris Hemsworth & George Miller Ignite Sydney For Epic Mad Max Launch

The Mad Max film franchise is Australia's cinematic gift to the world. That & Chris Hemsworth's near perfect cheekbones.

IAS Launches First-To-Market Integration With Roblox To Provide 3D Immersive Measurement

Always thought you could do with better 3D immersive measurement? Happy days are ahead here.

Fast And Furious: Top Gear Australia Launch Thrilled Motorheads, Car Entusiasts And Guests

B&T is still no closer to knowing who the new Stig is, except that she is a woman and a ridiculously fast.

TV Ratings (02/05/2024): Seven’s The 1% Club Wins The Night

The 1% club did not live up to its name when it comes to TV ratings last night.

TRA Welcomes Raft Of New Hires; Bolstering Expertise Across Markets

Insights and research agency TRA announces slew of new hires. Still no news on the return of marble wash denim, however.

CX Lavender Hires Boston Consulting Group’s Kim Verbrugghe as Chief Strategy Officer

CX Lavender announces new strategy hire and channels 'acoustic folk act at local RSL' for the publicity pic.

Opinion: Community standards, will they be the death of us?

This columnist is talking community standards. Sadly not those people who put dogs in trolleys in supermarkets.

Tegel gets heads bobbing with new free-range chicken platform

Sure, there's a lot of moral considerations when buying a chook. Yet, not as baffling as buying eggs or canned tuna.

Study: 66% of Aussie men believe masculinity is under attack

Two-thirds of Aussie blokes say masculinity's under attack. That said, sales of Solo lemon drink appear robust.

‘Equal Writes’: Canyon reveals new campaign and refreshed brand for women and non-binary writers

As this brand redesign again proves, nothing beats black on white. Well, white on black in this instance.

Icon Agency bolsters consumer and integrated offer with major hires

Icon Agency unveils new recruits. As press photo confirms office moustache competition now a lay-down misère.

Clemenger launches agricultural graduate program

Has Farmer Wants A Wife triggered an interest in dagging & hay balers? This grads program may resonate.

Levi’s Appoint UM As Global Media Agency For $217m Account

Levi's are the jeans for rockstars, models & the cool kids. Although that's not stopped dads from ruining their image.

QMS Nabs Sean Rigby From oOh!media

Things set to get spicy at the next Outdoor Media Association dinner and dance as a rival gets poached.