Mindshare Study: Amazon’s Australia Launch Lifts Ecommerce For Aussie Sites

Amazon’s launch in Australia helped grow online shopping traffic 9.1 per cent and boosted interest in Australian ecommerce sites, according to the latest analysis from Mindshare.

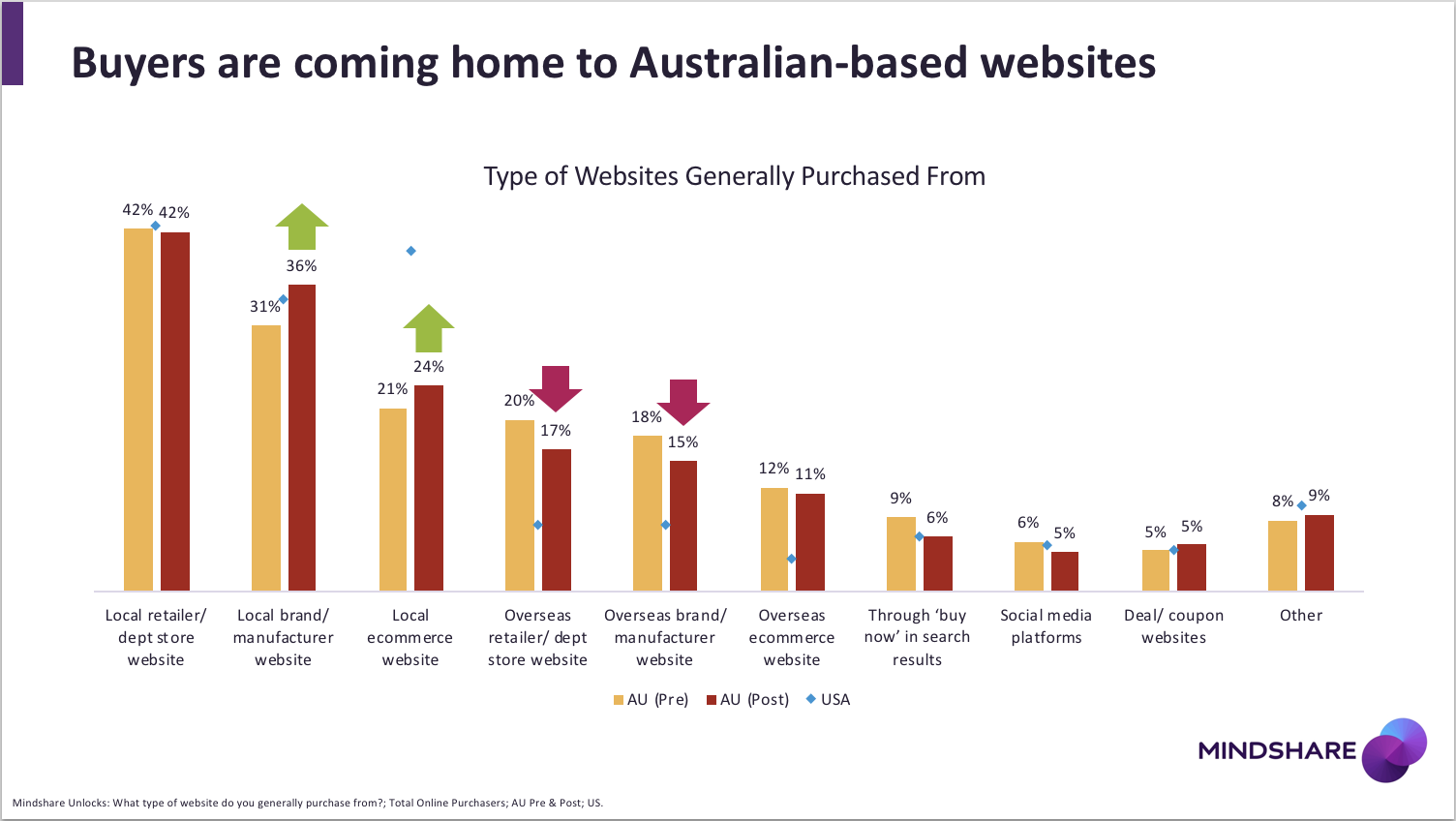

In good news for local businesses, Mindshare’s research found that after Amazon’s launch Australians have begun to turn away from overseas retailer and brand websites, preferring to increase spending with locally based ecommerce and brand websites.

Amazon itself has grown 24% post-launch (Feb-Apr 2018 vs Feb-Apr 2017), adding 1.3 million visitors per month. It’s a significant turnaround after dropping 11% in 2017.

Analysis of website traffic also found the majority of local brands, including Catch, Kogan, Kmart and Dan Murphy’s, grew penetration following the launch of Amazon.com.au.

Not all brands are thriving, however, in particular mid-sized, specialist brands with lower awareness and consideration for their online offering. Many are operating in traditional areas of strength for Amazon.com, with EB Games, Booktopia and Harvey Norman – as well as market leader Ebay – all losing traffic year-on-year.

Mindshare Chief Strategy Officer Australia, Joe Lunn says: “Amazon.com.au’s imminent arrival pushed other retailers to lift their game and create a better online shopping experience for customers, which in turn has benefited the whole sector. People are coming home to local retail and ecommerce sites and that’s a good story for Australian brands and businesses.”

Prime opportunity

The research looked at online shopping behaviours before and after Amazon’s Australian launch, in order to cut through the hype and evaluate Amazon’s true impact on the Australian marketplace.

Price and delivery costs are unsurprisingly the two most important factors for Aussie shoppers. However Americans have higher expectations from their ecommerce providers, with their appreciation for Amazon.com driven more by the overall offering, despite years of aggressive discounting.

By contrast, consideration for Amazon.com.au has dropped from 19% to 15% post-launch, with price and delivery the two major barriers. However positive perceptions of Amazon.com.au align closely to Amazon.com’s positioning with US customers, although it’s still very early days in the brand’s development locally.

The introduction of Amazon Prime, which will bundle free delivery with unlimited video and music streaming packages, will be key to addressing pricing concerns locally.

Mindshare’s research found that on average people would be willing to pay $14 per month for Amazon Prime, with that increasing to $22 for millennials (18-34) and up to $32 for frequent online buyers.

Prime is crucial to the success of Amazon, because they don’t appear to be converting as many young, heavy online shoppers at this early stage. As a result, most sales post-launch appear to have come from existing Amazon shoppers, with the original early adopters of Amazon still tending to use the site for the traditional ecommerce categories of books, DVDs and CDs, followed by clothing and accessories.

Lunn added: “Amazon.com.au didn’t quite live up to the pre-launch hype. Previous users of Amazon.com were the most excited, but they were also the most disappointed, with excitement dropping from 41% to 28%.

“Amazon doesn’t yet appear to have convinced them to make the switch to the local platform, which possibly explains the company’s decision to use the GST changes as a prompt to switch off local access to Amazon.com.

“It’s still early days for Amazon, but they’re playing the long game and they’ve built the brand foundations to mirror their US success. Free and fast delivery are the key selling points of Prime and Aussies are ready to pay for it. Prime is going to be a game-changer.”

The methodology

Mindshare collaborated with various WPP partners in the delivery of this study, including Kantar Millward Brown, Kantar Retail, GroupM’s [m]Platform, Hogarth, Shop+ and FAST.

5,500 respondents were surveyed using Kantar’s Ignite panel and GroupM’s LIVE Panel, in a nationally representative sample of People 18+ across Australia (n=4,500) and the US (n=1,000). Respondents were matched to digital behaviours using GroupM’s [m]Insights planning tool. Website visitation data was sourced from Nielsen Answers. Global Amazon penetration was sourced from Mindshare’s Mindreader Survey 2017 (n=50,000).

The media partner for the research study was News Corp.

Latest News

Sydney Comedy Festival: Taking The City & Social Media By Storm

Sydney Comedy Festival 2024 is live and ready to rumble, showing the best of international and homegrown talent at a host of venues around town. As usual, it’s hot on the heels of its big sister, the giant that is the Melbourne International Comedy Festival, picking up some acts as they continue on their own […]

Global Marketers Descend For AANA’s RESET For Growth

The Australian Association of National Advertisers (AANA) has announced the final epic lineup of local and global marketing powerhouses for RESET for Growth 2024. Lead image: Josh Faulks, chief executive officer, AANA Back in 2000, a woman with no business experience opened her first juice bar in Adelaide. The idea was brilliantly simple: make healthy […]

Is Meta’s New AI Chatbot Too Left-Wing?

Meta's chatbot accused of being left-wing after being caught wearing a Che Guevara T-shirt & listening to Billy Bragg.

TV Ratings (23/04/2024): Why Did No One Tell Angela That Farmer Wants A Wife Is Set On A Farm?

As wonderful as this headline is, let's face it, we all know an 'Angela', don't we?

PubMatic Unveils New AI Partnership To Turn Social Posts Into Ads For Any Digital Channel

Here's some nifty tech for turning social posts into ads. Assuming said posts aren't one-star character assassinations.

Intuit Mailchimp Makes A Splash With Its First Australian Brand Campaign

Ever laugh along at a gag you didn't get so as not to appear dumb? Get ready for more feigning with this new work.

GumGum’s Rob Hall: Advertisers Can No Longer “Rely On Binary Descriptions” Of Consumers

If anyone's got their finger on adtech's pulse, it's Rob Hall. He also avoids using the good paper in the office printer

Mastercard Nabs Florencia Aimo From Marriott International

Marriott International's Florencia Aimo jumps from the hotel business to the exploitative credit card one.

Bastion Agency Appoints Cheuk Chiang As New ANZ CEO

Cheuk Chiang takes the reins over at Bastion Agency. But not the rains down in Africa.

Spotlight On Sponsors: Major Sponsorship Wins After A Disappointing Week In Sport

B&T continuing our deep dive into local sport sponsorships & that's despite not a single offer of a free ticket as yet.

Macca’s Marketing Director, Samantha McLeod On Big Mac Chant: “What Was Once Old Is Now Cool Again”

Macca's using the power of nostalgia in latest Big Mac campaign. Well, only for those who've ever eaten one sober.

World Premiere Of Midnight Oil: The Hardest Line To Open Sydney Film Festival 2024

Oil's biopic to open Sydney Film Festival. Here's hoping Molly Meldrum will take his pants down at the premiere.

Entries Are Now Open For The 2024 Brandies, IntelligenceBank’s Annual Brand Marketing Awards

The Brandies are, of course, a prestigious marketing gong and not the mystery tipple favoured by nannas everywhere.

The Fred Hollows Foundation Appoints Ardent For PR

Yes, we all like to have a joke at PR's expense. But sometimes it does important work, like this.

AI, eCommerce & Marketing Specialists Are In Increased Demand By Businesses, New Data From Fiverr Shows

Has your philosophy & anthropology degree left you with nothing but a huge HECS debt? Here's what you should've studied.

Perth’s First 3D Anamorphic Billboard Arrives Courtesy Of oOh!media

Do you love a buzzword? Now you can add anamorphic to the list as it relates to billboards, not a colleague's ears.

MasterChef Australia & Crown Resorts Launch Unique Dining Experience With ALUMNI

A pop-up restaurant staffed by MasterChef contestants! That's fine dining prices for first-year apprentice chef cuisine!

Amanda Laing Announces Resignation From Foxtel Group

Foxtel's chief commercial & content officer heads for the exits. Read nice things the bosses said about her right here.

The Lost Letters From Our Diggers: News Corp Unveils ANZAC Day Special

It's nice when brands respectfully acknowledge ANZAC Day.

Howatson+Company Acquires Akkomplice

Large indie acquires a slightly smaller indie. Much like a shark eating a tuna, just with less thrashing and blood.

Google Delays Third-Party Cookie Deprecation Again

In good news for the sale of picture library biscuit photos, Google continues to tease over the end of cookies.

Education A Low Priority For Aussies More Concerned With Cost Of Living Forethought Study Reveals

Study finds Aussies cutting back on education due to cost of living. Booze & Uber Eats sales remain largely unaffected.

“I’m Still The Same Person That I Was”: Rikki Stern Says “Fucc It” To Cancer Stereotypes

B&T always happy to promote the anti-cancer cause. Even brands that massively overdo it with the hot pink.

The Unapproved Climate Certification Allegedly Causing Mass Greenwashing

Are you left flummoxed in the canned tuna & free range eggs aisle? Just wait till this green certification gets up.

TV Ratings (22/04/2024): Fans Mock “Over The Top” Reaction To New MasterChef Judges

MasterChef returns for its 2024 season. B&T stands by putting peppercorns in Gravox & no one will be any the wiser.

Dentsu Restructure: Muddle, Harvey & Johnston Take Leadership Baton As Bass & Yurisich Exit

A large broom has swept through Dentsu's local ops this morning, taking with it some big names & the air con's cobwebs.

Industry Shares Trends Shaping The Industry This International Creators Day

B&T's asking adland creators to reveal their top trends. And it's not good news for your Jenny Kee cardigan collection.

Mable Extends HOYTS Sensory Screenings Partnership

Mable has extended its HOYTS sensory screening partnership. Vigorously defends its two-star Oppenheimer review.

Orphan Launches ‘They Need Our Help. We Need Yours’ For Children’s Cancer Institute

Anything to do with childhood cancers has B&T's 110% support. That said, we do ignore the red meat & alcohol warnings.

Smile Team Orthodontics & Keep Left Collaborate On Smile-Inducing Campaign

As parents would attest, given the cost of orthodontics you'd expect this campaign to be a lavish production indeed.

Opinion: How Video Calls Neglect Learning Diversity

Need an excuse to duck out of a video call this arvo? Show this to your boss.

DoubleVerify Achieves First-Of-Its-Kind Responsible AI Certification From TrustArc

DoubleVerify receives responsible AI certification. However, not its robotic vacuum that's been seen menacing the cat.

Smile For A Good Cause: The Social Media Campaign Giving Back To The Community

Are you known as the office Austin Powers? More for you teeth than shagability? Get snappy new fangs with this news.

Elon Musk Mocks Albo After ESafety Wins Court Injunction Against X

Albo's 2024 from hell continues - Rabbitohs in crisis, down in the polls and now feuding with world's richest man.

Real Estate Developer In Hot Water Over “Sexually Exploitative” OOH Campaign

Real estate agents again tops in the 'least trusted profession' polls, nudging used car salesmen & ad creatives.

Epsilon’s Shane Hanby: Post-Cookie Era Relies On “Teamwork” Between Brands, Marketers & Tech

This pro predicts more "teamwork" in a post-cookie era. Which spells bad news for the uncooperative or plain stubborn.