Brands in the automotive, consumer services, and entertainment sectors are leading in customer experience and online reputation management, while real estate, retail and restaurants businesses continue to fall behind, InMoment’s 2025 APAC Reputation Benchmark Report has revealed.

In an environment where 94 per cent of consumers walk away from a brand after just one bad experience, the new report finds that a four-star rating is no longer a differentiator – it’s the minimum, with top-performing brands generating more reviews, responding faster, and leveraging customer feedback to drive growth.

Top-performing brands maintain average ratings of 4.5 stars or higher and generate twice as many reviews per month as the rest of the market, according to InMoment’s benchmarking. These sector leaders are also far more responsive, with reply rates exceeding 95 per cent and many responding to customer feedback in under 24 hours. Meanwhile, the underperforming sectors lag across key experience markers, signalling significant risk to reputation and brand presence.

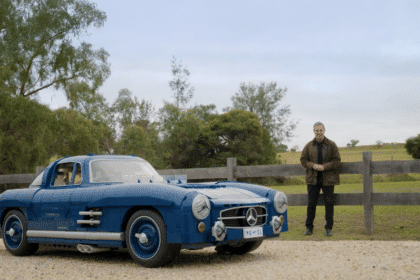

Photo and media usage has also emerged as a key differentiator, with brands that proactively upload owner-generated content and encourage customer-shared visuals achieving significantly higher engagement, reflecting a broader trend of businesses that invest in their online presence seeing stronger connections with customers and tangible commercial benefits.

David Blakers, managing director APAC, InMoment, said: “Reputation has become a frontline driver of growth and customer acquisition. This year’s data confirms that brands actively managing their online presence – particularly by generating reviews and responding in near real-time – see up to 268 per cent more Google profile views and 13.4 per cent more conversions as a result. Stronger online reputation helps stronger customer trust, search visibility, and ultimately, better business outcomes.”

Drawing on more than 31 million customer reviews across 226,500 business locations, the report identified reputation leaders by industry, including retail, hospitality, financial services, and healthcare, to highlight key CX trends across Asia-Pacific.

The analysis, based on data from platforms such as Google, Facebook, Yelp, and TripAdvisor, assessed key performance indicators, including review volume and velocity, average star ratings, sentiment analysis, photo and media usage, and response rates and times.

Blakers added: “This data-driven report equips marketing and CX executives with the benchmarks needed to evaluate their brand’s current standing and uncover areas for improvement. With Google Profile views and reviews directly impacting local search performance, brands can no longer afford to treat reputation as a passive metric – it must be owned, measured, and acted on.”

InMoment clients such as Specsavers, Yo-Chi, Solotel Group, and Betty’s Burgers have adopted proactive strategies to improve their review ratings, increase engagement across their Google Profiles, to drive measurable impacts at the local level.