Uber’s advertising business has delivered another strong quarter with revenue crossing a $1.5 billion annual run-rate, growing over 60 per cent YoY despite overall revenue falling short of predictions.

“Notably, we announced a partnership with Instacart’s Carrot Ads solution in the US to help extend the reach of Sponsored Items to more than 7,000 CPG brands of all sizes. By partnering with third parties for our G&R adtech platform, we have been able to prioritise investments in restaurant delivery and our nascent Mobility ads business,” said Dara Khosrowshahi, CEO of Uber.

Khosrowshahi said that the brand continues to be positively surprised by the strong appetite for restaurant delivery advertising, which is now approaching 2 per cent of Delivery Gross Bookings, and continues to grow at over 60 per cent YoY, with steady growth in both advertiser count and budget per advertiser.

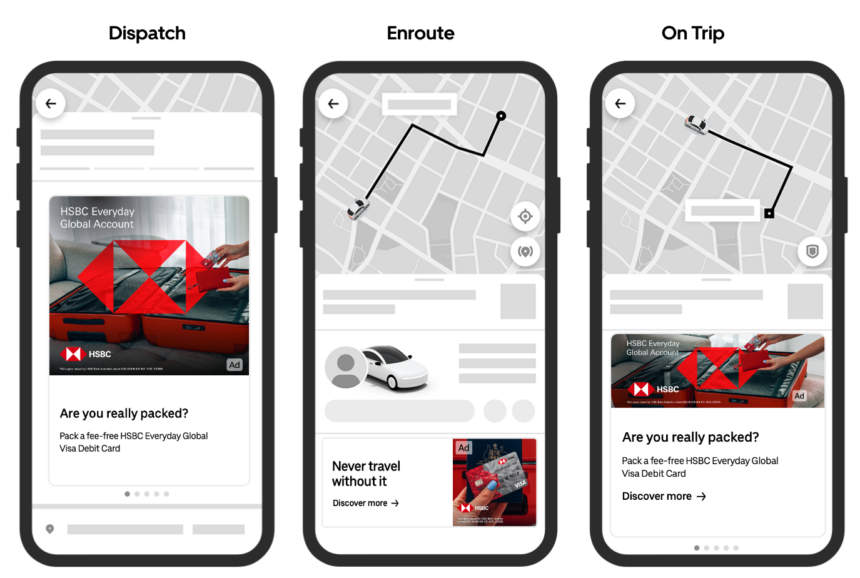

“Our Mobility ads business continues to significantly outpace overall advertising growth, driven primarily by Journey Ads in the Uber app, which continue to expand globally”.

Overall, Uber Technologies, Inc. reported weaker-than-expected revenue for the second quarter, signaling a slowdown in the company’s once-booming ride-hailing business. For the quarter, Uber posted revenue of $11.5 billion, representing a 14 per cent increase year-over-year. However, this figure fell short of Wall Street analysts’ expectations.

Despite the revenue miss, gross bookings, which include the total dollar value of rides, deliveries, and other services, also rose 14 per cent year-over-year to $42.8 billion. This growth was in line with revenue increases, suggesting a steady performance across Uber’s broader platform.

Operationally, Uber reported an income from operations of $1.2 billion, showing a significant improvement over the prior year. The company also recorded net income of $1.8 billion, bolstered in part by a $51 million pre-tax benefit stemming from the revaluation of its equity investments.

On an adjusted basis, EBITDA (earnings before interest, taxes, depreciation, and amortization) came in at $1.9 billion, a 35 per cent increase year-over-year. Uber’s adjusted EBITDA margin, measured as a percentage of gross bookings, rose to 4.4 per cent, up from 3.7 per cent in the first quarter of 2024, indicating improving efficiency and profitability.

In terms of cash flow, Uber generated $2.3 billion in net cash from operating activities. Free cash flow—defined as operating cash flow minus capital expenditures—also came in at $2.3 billion, demonstrating strong liquidity and financial discipline.

As of the end of the quarter, Uber held $6.0 billion in unrestricted cash, cash equivalents, and short-term investments, providing the company with a solid financial cushion amid ongoing market uncertainties.