I thought this month I’d zero in on Mary Meeker’s KPCB Internet Trends 2014 Report published May 28th.

KPCB’s Report felt in some way less seismic in its impact as in previous years. On reflection this is probably because the Richter scale has been given a good working over since this Report’s first edition, and we’ve become accustomed to eye-watering growth figures etc. So context is everything, but when you look deeper, the changes sweeping the digital and mobile world remain immense.

Here are a few points I thought interesting.

Tablets are growing faster, (+53% during CY13), than PC’s did at anytime in their lifecycle with still huge growth forecasted. Smartphones that feel ubiquitous, particularly amongst this readership I suspect, have reached 30% of the total global 5.2Bn mobile base, so again, huge growth possible. This is assisted by the increasing affordability of the devices, with the cost of a unit decreasing about 5% annually since 2008. Mobile usage has reached 25% of total global web traffic, growing from 14% just last year, with Asia remaining the most mobile centric region with 37% of all page views (StatCounter, 5/14). In terms of hardware in our region, of the established smartphone markets, Japan ranks 2nd , Korea 5th , and Australia 9th. Of the so-called developing smartphone markets, China ranks 1st , India 2nd , Indonesia 4th , and the Philippines 10th . Shipments of smart devices are now tracking at 4-5x that of TV’s or PC’s.

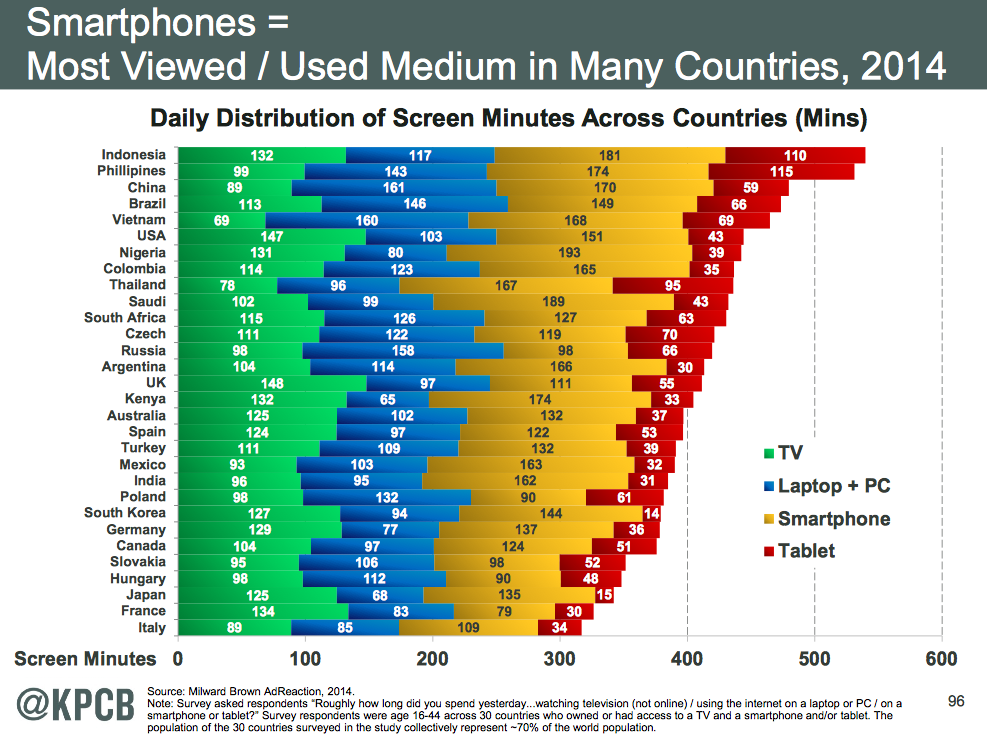

The Report highlighted data from Millward Brown’s AdReaction 2014 study showing how many minutes the populations of 30 countries, that together represent 70% of the world’s total population, spend looking at ‘screens’, the previous day. Screens were laptop, smartphone, tablet and also the TV screen, See chart below. The headline is that smartphones/tablets are the most viewed and used in many countries with four APAC markets in the top five; Indonesia, Philippines, China, and Vietnam, with the first two of those markets indexing particularly high also in tablet share. Slightly lower down the list, at 9th is Thailand, indexing very high in smartphone and notably in contrast the lowest of all 30 countries in TV share. Australia’s smartphone share is close to the average across the 30 countries surveyed, with tablets indexing lower.

Mobile data traffic achieved growth of +81% yoy with video a strong contributor. This is hardly new but it’s evidence that there’s voracious appetite for mobile content. The creation of high caliber programming and ad content to be put in front of quality audiences couldn’t be a bigger priority.

The Report cites a big revenue opportunity gap of $30Bn (USA) for Mobile to take up, this is based on time spent on device which is an often used metric but flawed I think, but whatever methodology, of course there’s a monetisation lag. The mobile industry’s capacity to exploit this undeniable opportunity is improving with the focus being applied in the right areas such as targeting and transparency. This does vary widely across our region but in Australia for instance, Mobile is taking increasing chunks of share with 21% of all Display in Australia that of Mobile Display, (iAB Australia).

China and its nearly 500 million Internet users come in for attention this year. Chinese internet brands are traveling at light-speed. Last year, only Tencent was in the top ten globally, this year it’s joined by three others; Alibaba, Baidu, and Sohu. And it’s Tencent’s mobile business that’s the stand-out, with WeChat proving to become a powerhouse of m-commerce with it’s 400 million active chat users using the service to pay for taxis, (5 million rides per day – March 2014), restaurants, and social gaming.

Looking at second-screening at home, (USA), sees 84% of mobile owners using devices while watching TV. Most common activities shows 49% of people surfing the web on smartphone and 66% on tablet. And shopping, (I assume including the ‘window’ variety), being undertaken 24% on smartphone and 44% on tablet.

The area of this years Report that is the most interesting is where we’re headed. Mary Meeker and her colleagues spend a large section on the intersection of findable and shareable data, wearable’s, sensors, and the internet of things, and this of course has great relevance to mobile. Data points such as, 1.8Bn photos uploaded and shared per day, Pintrest having 30Bn ‘pins, and 800M swipes a day on Tinder point to exponential behavioral changes. In fact IDC has two thirds of the digital universe being consumer originated. IDC also thinks that 34% of this sort of data could be useful. This is data from embedded systems, social media, photos, sounds etc), with 7% tagged, and 1% analysed so far. A good example of where this plays out is with the Jawbone health wearable which so far amongst it’s user base, has logged 27k years worth of sleep, and where it’s technology manages and makes sense of 50Bn activity data points every week then presents it’s insights on a rather nice app.

So across the 160 pages, there’s no lack of quality data, and it’s worth a read. For me the themes are, the mobile ecosystem continues it’s relentless advance, data and how it’s structured and used is gathering pace, second-screening is here to stay, better and better interfaces are helping drive traffic to mobile, and therefore, the opportunity for marketers has never been greater.

Mobile Hub.

Graham Christie

Partner, Big Mobile Group.