The second annual Global Review of Data-Driven Marketing and Advertising revealed that data is playing an increasingly central role as a pillar of marketing, advertising and customer experience practice around the globe.

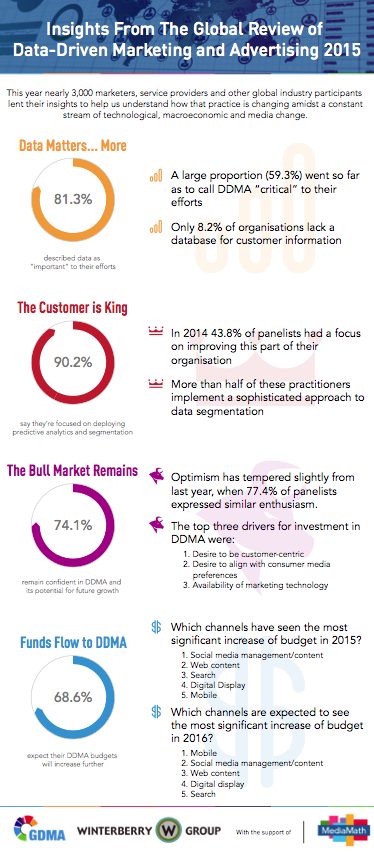

A massive 81.3 per cent of marketers have described data as important to their efforts, an increase from 80.4 per cent in 2014, while 59.3 per cent are calling it ‘critical’ to their efforts, up from 57.1 per cent in 2014.

The study, conducted by GDMA (an alliance of 27 independent marketing associations around the world) and U.S. research and consulting firm Winterberry Group indicates that 74.1 per cent of marketers remain confident in the value of data-driven marketing and advertising (“DDMA”) and its potential for future growth.

Among the survey’s 17-nation panel, 56.3 percent said they increased their annual DDMA expenditures last year, while 68.6 per cent expect to increase spending further in 2016). These metrics were slightly down on 2014 levels (when 77.4 per cent of panellists indicated confidence in DDMA and 63.2 per cent increased their respective spending since the prior year).

The year-on-year dip could reflect the finding that participants cited improved measurement and attribution techniques as the single most important initiative would support their organisations’ ability to drive more value from DDMA.

The Global Review’s findings were compiled through an online survey of 2,938 advertisers, marketers and other industry participants, in 17 countries, between July and September 2015.

It is the largest study of its kind undertaken by a global consortium of marketing associations and aims to provide insights into how technological, macroeconomic and media change is transforming the marketing and advertising landscape and enable marketers to benchmark their campaigns, allocate budgets in line with global best practices and develop strategies for using data in meaningful, responsible and consumer-friendly ways.

“Data-driven marketing is increasingly impacting business functions and shaping whole of business strategy,” ADMA CEO and GDMA chair Jodie Sangster said.

“Technological advances are transforming the ways organisations can harness data to meet business objectives but it is clear that measurement and attribution methodologies need to evolve in order to better support marketers build value case.

“Improved measurement capabilities along with an appetite for more skills and training around analytics are a global requirement and should be a key focus of our industry in order to continue to foster growth and innovation.”

The key findings of the report are:

• Data matters… more:

Among nearly 3,000 experienced marketing and advertising practitioners across 17 global markets, 81.3 per cent described data as important to their is the largest study of its kind undertaken by a global consortium of marketing associations.

In addition, these big guns agree that data aims to provide insights into how technological, macroeconomic and media change is transforming the marketing and advertising landscape and enable marketers efforts, representing an increase from an already large majority (80.4 per cent) who said the same one year ago. An even larger proportion (59.3 per cent, versus 57.1 per cent last year) went so far as to call it “critical” to their efforts.

The bull market remains in force (though may be tiring):

74.1 per cent of worldwide panellists said they remain confident in the practice of DDMA and its potential for future growth, though optimism tempered slightly compared to a year ago, when 77.4 per cent of panellists expressed similar enthusiasm. With respect to individual markets, this “confident majority” grew in only one country, Germany.

Measurement is the key:

The global participants called for improved measurement and attribution techniques and better training in respect to analytics and audience segmentation when asked what would help advance their ability to derive value from DDMA programmes. Panellists benchmarked (on a 1-to-5 scale with 5 indicating a factor is ‘critical’ to deriving more value) improved measurement at 4.24 with better staff training at 4.22).

The customer is king:

For the second year in a row, global panellists said their desire to be “customer-centric” is fuelling their DDMA efforts more than any other single priority.

First-party data rules:

Far fewer practitioners are engaged in the use of “third-party” data (which typically includes compiled, commercial datasets that are licensed on an open market) to support their acquisition marketing efforts. Just under two-thirds of the global panel (65.5 per cent) said that third-party data licensing is included among their DDMA use cases.

Funds continue to flow to DDMA:

More than half (56.3 per cent) of global panellists said they increased their annual DDMA expenditures this year, though the extent of that spending growth dipped slightly compared to the 63.2 per cent that said they did the same last year.

Further, 68.6 per cent expect that their organisation’s DDMA budgets will increase next year—a robust majority though slightly smaller than the 73.5 per cent that said the same last year (regarding their expectations for this year’s spending)

Digital, digital, digital:

Panellists said they increased their proportional spending on social media, web content, search and online display advertising more over the past year than on any other addressable channel, reflecting the findings of last years’ research but with more consistency across markets. This is likely because these are the media that are delivering the greatest improvement in return-on-investment.

“Both data and the practice of ‘digital’ represent an industry transformation that is truly global in its scale. And our second annual study reveals a wealth of commonality of experience, learnings and challenges between marketers around the world,” Winterberry Group MD Jonathan Margulies said.

“Data is adding value to enterprises across the globe and the research offers an important validation of how responsible marketers intend to use, and safeguard, data for the betterment of consumers’ everyday brand interactions.”