There is soccer, and there is the Soccer World Cup.

Treated as a brand, ‘soccer’ has an established but niche profile in Australia, however when it comes to World Cup soccer, the proposition is dramatically different. It’s a brand in its own right, and a haven for brand sponsorship as can be witnessed with the plethora of commercial sponsors this year. Do Australians care about the World Cup? Without a doubt. The dynamic, prestigious, unique nature of the World Cup soccer places it on a different level as a brand.

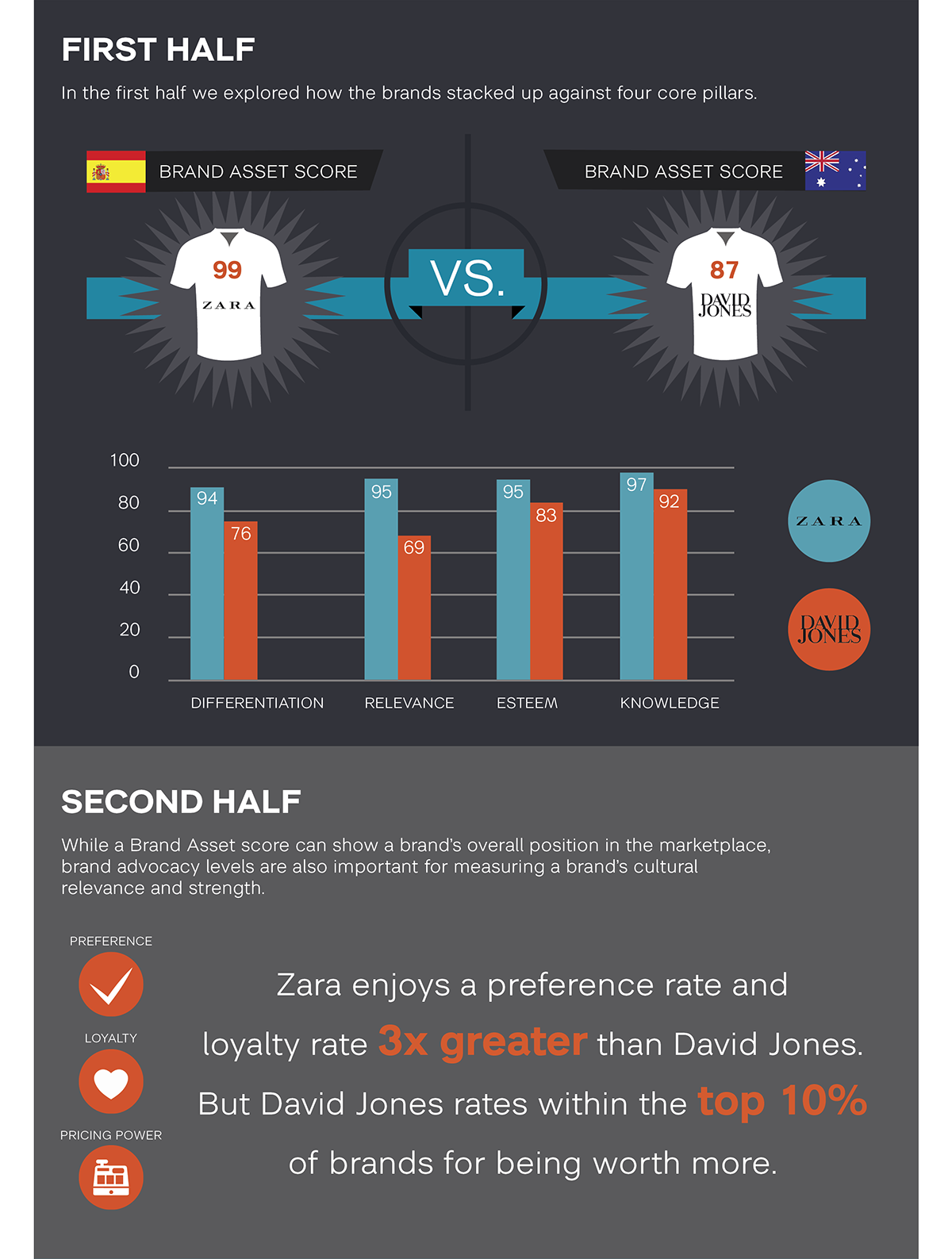

Data analysed by Y&R Group’s Brand Asset Valuator (BAV) ranks Soccer and World Cup Soccer against four factors: Differentiation, Relevance, Esteem and Knowledge. Whilst ‘Knowledge’ remains relatively constant for both Soccer and World Cup Soccer, ‘Relevance’ leaps by over 50% for World Cup Soccer vs. Soccer. When we split the demographic and see how this plays out with males, with high rankings across all four categories it is clear that World Cup Soccer claims to be a true Megabrand in Australia.

If equity exchange or reinforcement is carefully managed, World Cup Soccer is indeed a valuable brand partner.

But what would happen if we marched our culturally iconic brands onto the field of play to compete?

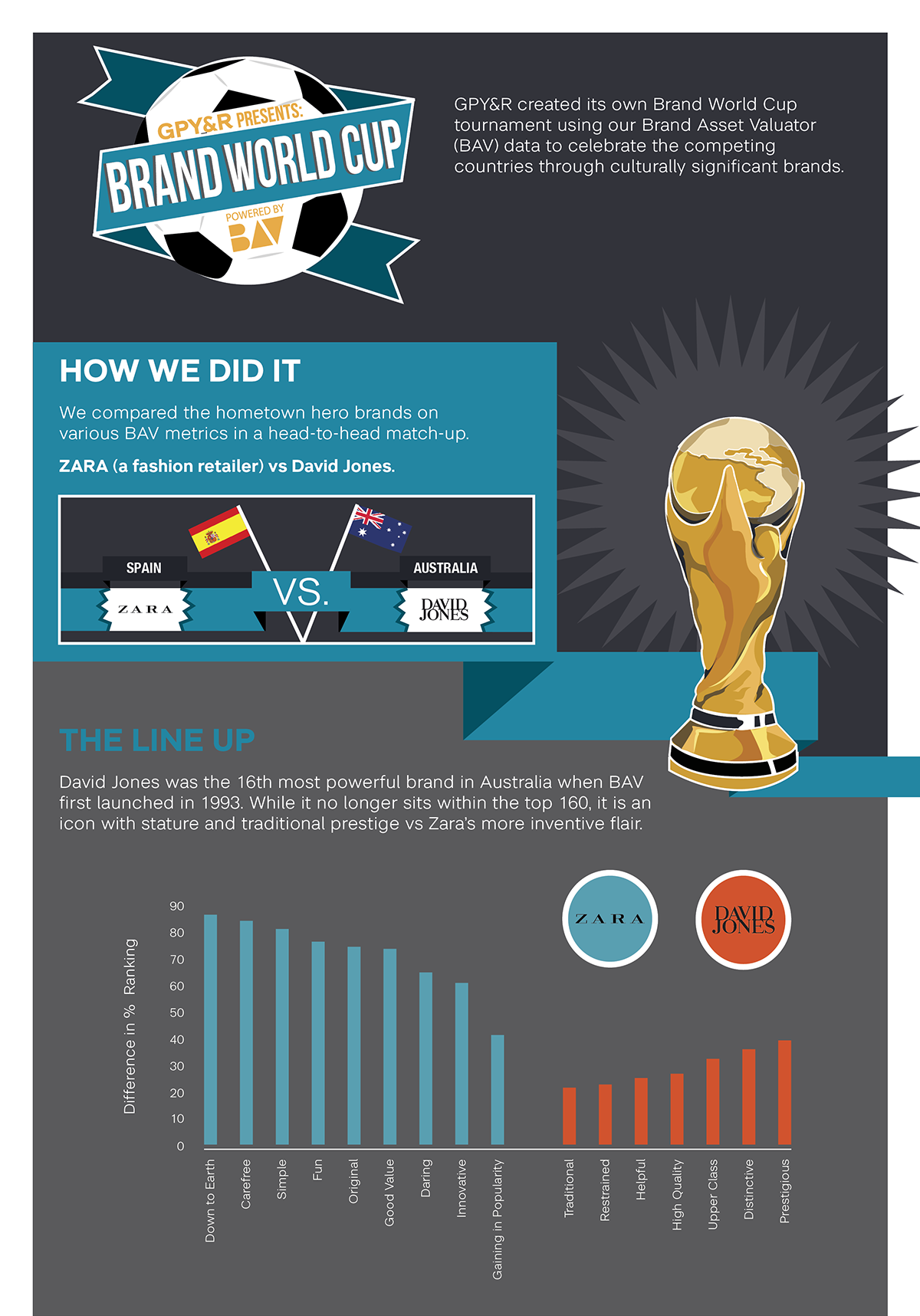

To celebrate tomorrow morning’s game against Spain, BAV put a Spanish brand head-to-head with an Australian brand. We can’t predict the outcome of the World Cup match, but what would happen if two brands went onto the field? In the infographic below, Zara and David Jones compete against the four pillars as well as Preference, Loyalty and Pricing Power.

David Jones was the 16th most powerful Australian brand when BAV first launched back in 1993. Whilst it no longer sits within the top 160 in Australia anymore, it remains for many Australians an icon to take on the young Spanish retailer.

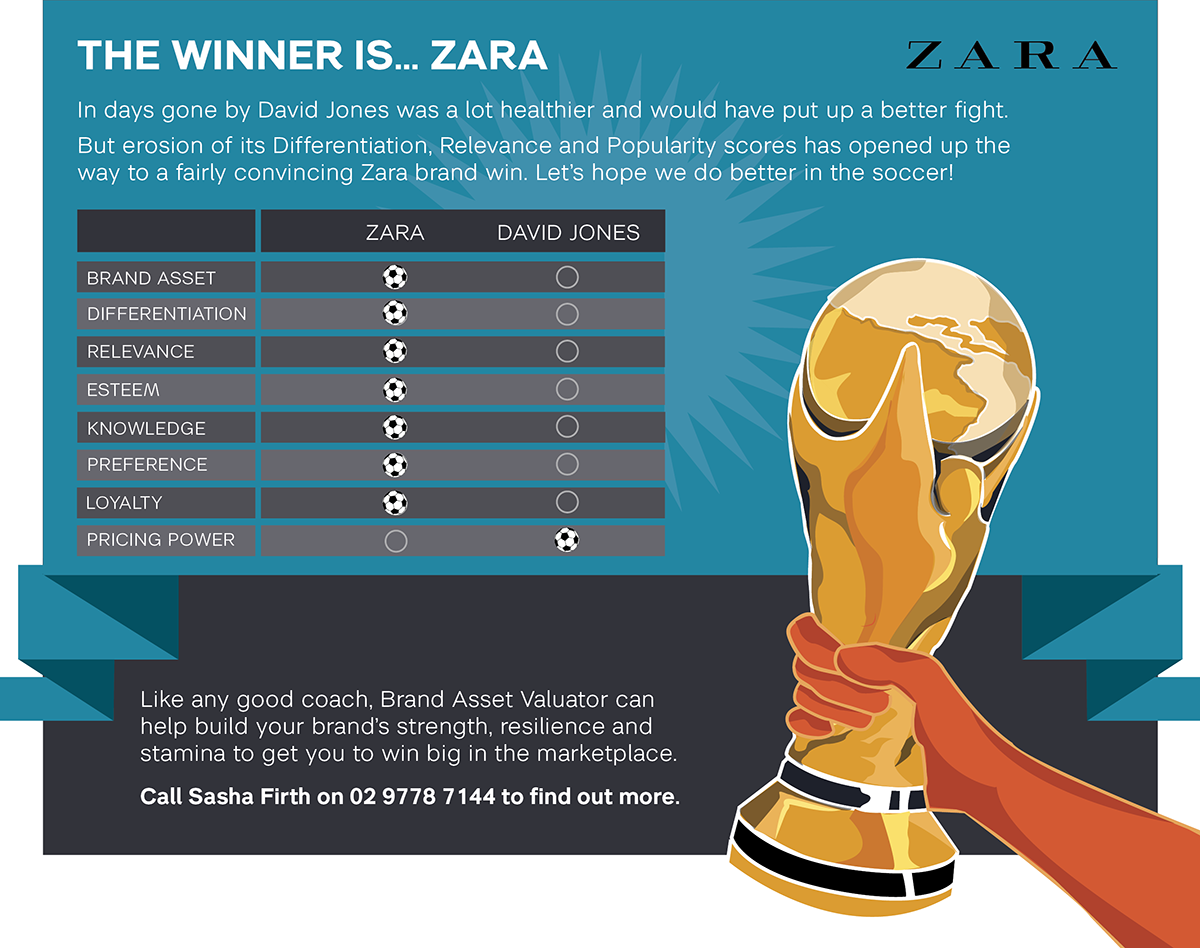

Some years ago, David Jones would have put up a better fight, but erosion of its Differentiation, Relevance and Popularity scores have opened up the way to a fairly convincing Zara brand win this year.

It will be interesting to see if it can harness some of the additional positive equity the brand still enjoys, to present itself as a reinvigorated threat in Qatar 2018.