Do’s And Don’ts For A Best-in-Class Loyalty Program

Brands are reinventing loyalty programs and turning them from cost centres into invaluable tools for collecting consumer data, driving customer engagement, and building brand equity. Digital – especially mobile – will be at the core of leading loyalty programs: Professor Scott Galloway argues one of the prime factors separating winning and losing brands going forward will be loyalty programs that use digital as connective tissue to learn about customers and provide them with satisfying consumer experiences.

DO: Use loyalty programs to incentivise engagement and product discovery.

DON’T: View loyalty a purely transactional.

Loyalty need not centre on transactions. In addition to purchase behaviour, brands can reward actions that directly and indirectly contribute to sales. Program members who write reviews, interact with the brand on social media, and post user-generated content prime the pump for online retail by enhancing the environment for other potential customers. Brands can also reward activities that drive product discovery.

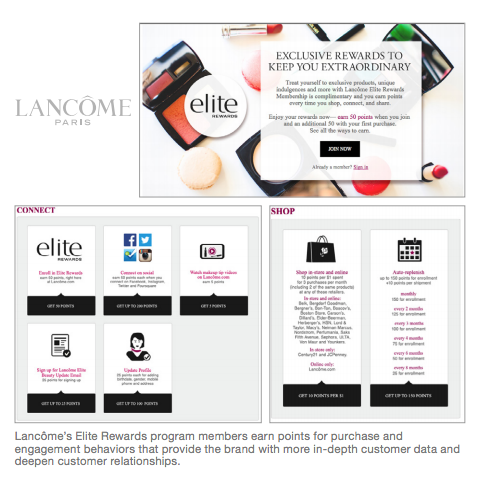

Brand examples: Lancôme’s Elite Rewards program gives points for watching video tutorials on the brand site (which can help drive conversions further down the purchase funnel) and for connecting a loyalty account to Lancôme’s social media profiles. Lancôme has indicated that writing product reviews will earn loyalty points in the future. Brands already rewarding this activity include South Korea’s Galleria Department Store. Kimpton’s Karma Rewards Program, which rolled out last year, offers perks for social media shoutouts. Walgreens’ rewards program lets shoppers earn points for visiting different store sections.

DO: Use rewards to preserve and enhance brand equity

DON’T: Limit incentives to freebies and discounts – and participate in a race to the bottom for rewards.

With an abundance of loyalty programs to choose from and a lack of benefit differentiation, customers become loyal to programs rather than brands. Instead of limiting membership benefits to free or discounted goods and services, which do little to foster meaningful customer relationships, brands can reward members in ways that encourage customer interaction without the intent of driving immediate conversion. Product exploration as a form of redemption can include consultation with stylists, samples, or early access to products. Exclusive experiences and enhanced customer service can help to deepen emotion connections to a brand.

Brand examples: Sephora provides pre-release access to specialty products, while Neiman Marcus gives wardrobe consultations. Hotels and airlines tend toward enhanced customer service rewards, leveraging technology to upgrade experiences —expedited check-in or priority boarding, for instance. Best Buy is among the retailers that lower spending thresholds for free shipping. The North Face VIPeak program provides climbing clinics and lift tickets, and Nordstrom offers invitations to fashion shows and intimate access to designer teams.

DO: Make mobile a cornerstone of loyalty programs

DO: Make mobile a cornerstone of loyalty programs

DON’T: Neglect to link myriad functionalities for loyalty members within the mobile hub.

Many brands are missing enormous opportunities to harness mobile apps to push loyalty programs to the next level. Brand apps can serve as a hub to integrate loyalty with couponing, for example, and enable seamless omni-channel shopping. Nearly three-quarters of mobile consumers report wanting to use their mobile devices to interact with their loyalty programs, but just 56% of studied retailers with transactional loyalty programs invested in consumer-facing, commerce-oriented mobile apps in 2014.

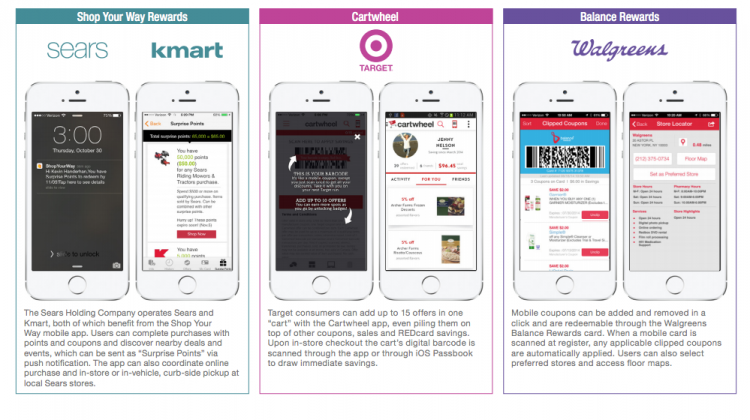

Brand examples: Starwood’s loyalty app integrates basic functionalities — including member profiles, stay and reservation history, and the ability to view point accruals and book using reward points — with elegant solutions such as keyless room entry and native geo-local functionality that lets users avoid data entry while completing local bookings. Walgreens’ best-in-class app effectively integrates its Balance Rewards loyalty program. Mobile coupons can be added and removed in a click; when a mobile “card” is scanned at register, any applicable clipped coupons are automatically applied. And Sears’ Shop Your Way app lets loyalty members complete purchases with points and coupons and discover nearby deals and events, which can be sent as “Surprise Points” via push notification. The app can also coordinate online purchase and in-store or curbside pickup at Sears stores.

DO: Make surrender inevitable for frequent customers

DON’T: Discourage consumers by making enrolment and benefits time-consuming and difficult to understand.

The best loyalty programs put customers who opt out at a distinct disadvantage. Mobile apps in particular are helping to make loyalty participation irresistible, as best-in-class apps serve as a gateway to seamless customer experiences — automatically applying coupons at point of purchase or faster and easier room booking or use of points as currency. In the hotel sector, loyalty programs should not only provide tangible rewards and discounts but also ease planning and booking, improve access to customer service and enhance the in-stay experience.

Brand examples: Starwood has been particularly savvy about transforming the guest experience. SPG Keyless lets loyalty members bypass the front desk and check in and access the room via mobile phone. With its Apple Watch app, Starwood even lets loyalty members pre-order drinks in advance of visiting the hotel bar. The Hilton HHonors app now allows guests to select a preferred room and request various amenities to be delivered to the room before arrival. For makeup fans who need to keep track of myriad product preferences, Sephora’s exemplary Beauty Insider program enables users to store sample, online, and in-store purchase histories in the “beauty bag,” retrievable across all channels.

DO: Collect and harness data

DON’T: Fear a privacy backlash.

Data and targeting capabilities are a loyalty program’s best assets, and the program itself can be used to effectively aggregate customer information that is otherwise untapped and siloed across an organisation. Data capture – both implicit and explicit, tying together online and offline – must therefore be a top priority for loyalty programs. Unfortunately, some marketers have shied away from using this data to create stronger offers, for fear of a privacy backlash. Privacy is overhyped relative to improving the customer experience. When offers are relevant and targeting is done well, negative repercussions will be minimal at best.

Brand examples: In some instances, brands are making the value exchange explicit. Lancôme’s Elite Rewards program gives points to customers who update their profile to include more in-depth personal data, such as address and gender, or those who sign up for a birthday email.

DO: Customise to markets

DON’T: Ignore local consumer behaviours and preferences.

It’s incredibly difficult to make loyalty work on a global scale. Brands must tailor strategy to local nuances while leveraging cross-market learning throughout the organisation.

Brand examples: Starbucks’ loyalty program, a model for all brands, spans 28 countries and is customized for each. In China, for example, Starbucks relies on gamification to drive participation. Starbucks’ U.K. program has the highest threshold to top-tier benefits and many more “soft benefits,” such as free add-ons like shots and flavours.

For more on how brands are raising the bar for loyalty programs, download a copy of L2’s Insight Report on Customer Engagement: Loyalty.

Please login with linkedin to comment

ad-blocker Advertising Standards Bureau ASOS Virgin Mobile AustraliaLatest News

TV Ratings (18/04/2024): I’m A Celebrity Wins Prime Time And Key Demos

Aussie viewers can be a harsh lot at times. Only days after Ellie Cole bled her heart out, she has been sent packing.

Effie&co Launches New ConnectAsia Division To Help Aussie Brands Market To Asian Consumers Overseas & At Home

Not provided is advice on using chopsticks and not spilling ramen down your shirt.

Cashrewards Sets Out Stall For New CMO

Thinking of applying for the Cashrewards CMO gig? Here are some insider tips that, yes, are tantamount to cheating.

‘I Ask For The TV Industry To Stand Up And Defend Itself’ – Seven Boss James Warburton Steps Down

The Seven supremo heads for the exits after five years. Here's hoping the Spotlight team organised the farewell bash.

Poh! Jamie! Adriano! Paramount ANZ reveals its tasty plans for this year’s MasterChef

It's your fan's guide to this year's MasterChef! Although no tips on how to pronounce crudités or use a un fait-tout.

Dentsu’s iProspect Partners With MOOD Tea Ahead Of May Campaign Launch

We love a Mood Tea here at B&T. Although we do store old screws and nails in the International Roast caterer's tin.

Opinion: When Culture Starts Eating Itself: Navigating The Age Of Self-eating Nostalgia

Born boss David Coupland asks is adland going through a nostalgia period? But please, no repeats of Best Of Red Faces.

Who’s Going To Cannes?! The TikTok Young Lions Winners!

It's Aussie adland's next gen! They're off to Cannes with high hopes of bringing back a Lion & a foot-long Toblerone.

Adobe Launches Express Mobile App With Firefly AI

Want to be the coolest kid at Friday staff drinks but forgot your retro Nikes? This new Adobe wizardry may do the trick.

ThinkNewsBrands & IMAA Extend News Publishing Education In Brisbane

Industry duo takes its publishing roadshow to Brisbane. Was disappointed no male attendees were wearing walk socks.

B&T Chats With Wavemaker’s Provocative Pioneers On Their Cross-Pacific Sojourn

B&T TV heads to Wavemaker's Sydney digs to interview two staffers from its New York & LA digs. If that makes sense?

HoMie & Champion Launch “Give One. Get One” Campaign Supporting Youth Homelessness Via Town Square

Much like the fête's prized chutney wears a blue winners sash, so too should this top initiative from HoMie & Champion.

Thinkerbell Takes Us Back To Summer In Latest Work For XXXX

This beer ad wants to take you back to summer! Just minus any chance of a shark attack on your morning bus commute.

Cannes Lions Unveils 2024 Programme Featuring Queen Latifah, Jay Shetty & P&G’s Mark Pritchard

Are you one of the lucky ducks heading to Cannes in June? Check out the headliner acts you'll be queueing hours to see.

Scroll Media Recruits Costa Panagos From Twitch

Costa Panagos set to bring South American flair to the Scroll offices. Assuming that he is, indeed, South American.

Year13, Microsoft & KPMG Australia Launch AI Course For Gen Zs

Born around the 2000s? Need to amp up your AI creds? This guide's for you (although it's not really that age specific).

General Motors Snares Heath Walker From Scania

Do you rage about oversized American cars on our roads? You need to bail up Heath Walker at parties & industry events.

VML Launches New “Envoyage” Brand For Flight Centre

VML unveils new brand for travel operator Flight Centre. Alas, no sign of those paid actors pretending to be pilots.

Subaru Places Media Account Up For Review

Subaru puts media up for review, as adland journos get set for mandatory "agency drives off with..." headline.

TV Ratings (17/04/2024): Contestants Faced With Harsh Realities As Alone Australia Heats Up (Or Cools Down)

Alone still doing the business for SBS. Overly long train journeys not doing the business, but they persist anyway.

Ben Fordham Loses Number One Spot As Ray Hadley Celebrates 156th Ratings Win

The radio numbers are in! Discover who's off for a boozy lunch today & who's waiting for the dreaded HR death knock.

Gourmet Ice Cream Brand Connoisseur Launches New “Thrill Your Senses” Iteration, Via SICKDOGWOLFMAN

Rattling the old "truth in advertising" adage comes this ice-cream spot full of noticeably thin people.

Paramount’s Global Sales Boss: ‘Australia’s Converged Model Is A Blueprint For How I’d Like All Of Our Markets To Be’

Paramount's global sales boss gives local sales ops the thumbs up. Didn't weigh-in on the Lisa Wilkinson debacle.

TikTok Starts Testing Its Instagram Rival In Australia

In exciting news for piano playing cats & brattish pranks in shopping centres, TikTok unveils its Insta rival plans.

Man Wrongly Named By Seven As Bondi Killer Hires Lawyers

Struggling to save for a house deposit? Why not get wrongly identified by Sunrise!

Smartsheet Appoints Indie Agency Sandbox Media To Its Media Account

Can't stand your colleagues? Like to dob them in when they miss a deadline? These work management platforms are ideal.

Boss Not Letting You Come To Cannes In Cairns? Use This Business Case To Convince Them!

Stingy boss won't spring for a ticket to Cairns? Add this to your persuasive argument repertoire. Or grovel.

Alt/shift/ Brisbane Builds Portfolio With Ausbuild Creative, PR, Content & Social Account Win

The Brisbane comms/PR agency lands constructor Ausbuild. Also hoping for a discount on its new glass conservatory.

Young Guns Versus The Old Guard: Who Adds More Value to Our Industry?

Cannes In Cairns poking this hornet's nest in a lively debate. Just so long as the oldies can get up the stairs.

70% Of Aussies Don’t Have Green Power Plans ENGIE Says In Major Brand Campaign Via HERO

Are you the notorious "light leaver on-er" in your flatshare? Quell any infighting with this green energy news.

PrettyGood Launches Offering Brand & Media Solutions For Australasian SMEs

B&T applauds the charitable nature of this new agency. Although we'd hate to see it impact any Chrissie present sends.

A Blunt End: Dolphins Medicinal Cannabis Sponsorship At Risk

Yes, it's another NRL drug story. Yet, thankfully it doesn't involve coke in Kuta during the off-season.

Slew Of New Creative Hires At Leo Burnett Australia

Ahhh, all black! The outfit of choice for agency creatives, David Jones staff and everyone in Melbourne.

Under Armour Unveils Local “Live in UA” Campaign

American apparel brand set for yet another tilt at the Aussie market, as Nike declares "we'll see about that".

Pepsi Launches New Look, Refreshing Classic Fashion Staples Via Special PR

Are you always the bridesmaid, never the bride, as the old saying goes? How do you think Pepsi feels?

Pure Blonde Returns To A Place Purer Than Yours In New Campaign Via The Monkeys

B&T's always been a huge fan of the 'drink yourself thinner' diet plan. So big thanks to Pure blonde, vodka & tequila.